Did you know the BCG Matrix can save public administration organizations up to $192 million1? This tool, from the Boston Consulting Group, is a game-changer. It helps companies improve their product portfolios and use resources better.

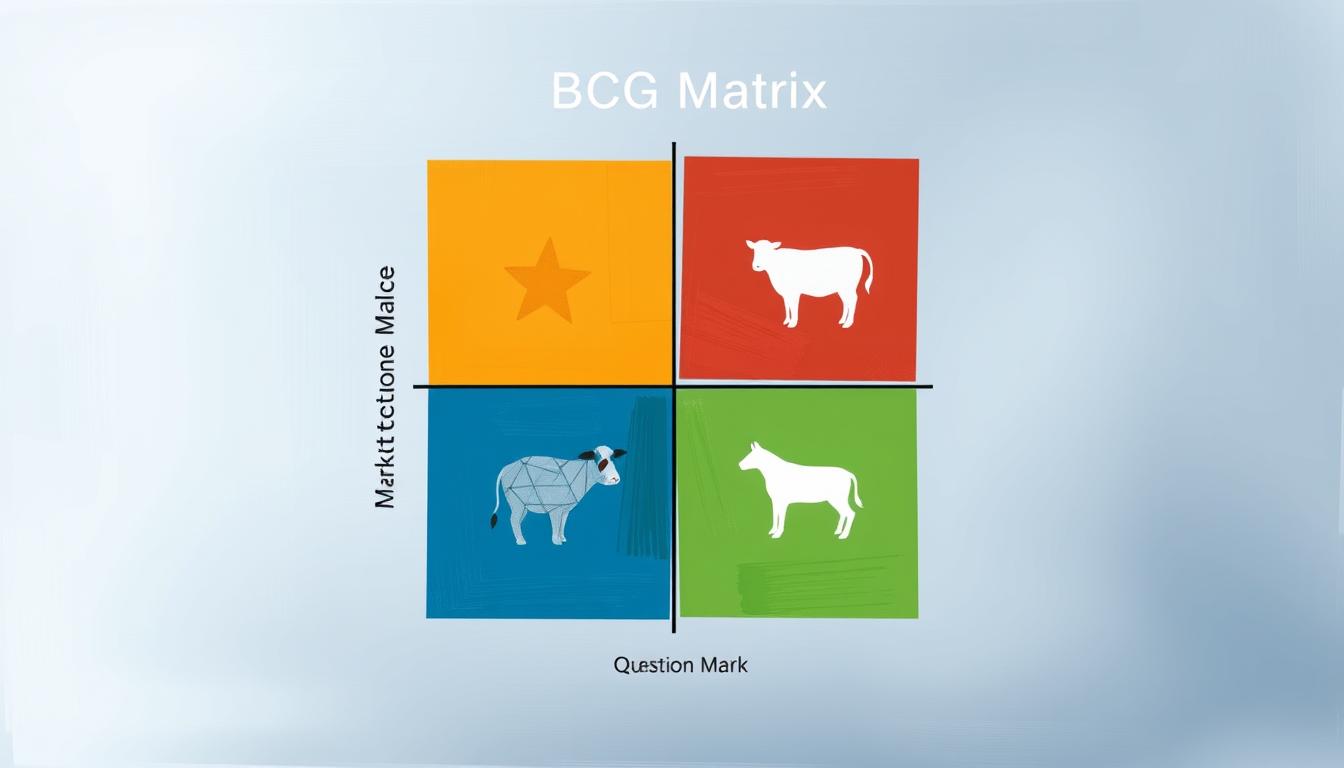

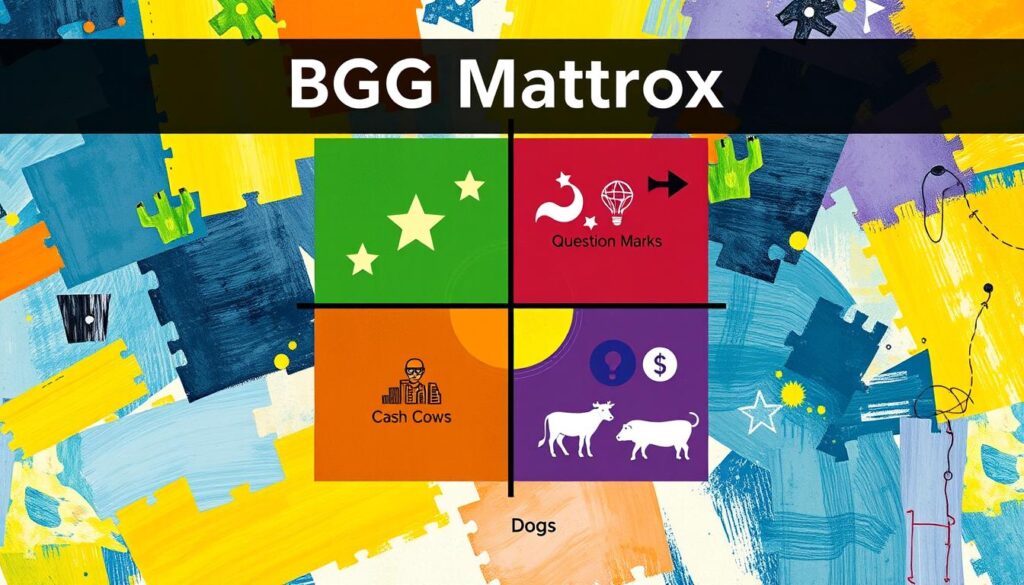

The BCG Matrix sorts products into four groups: stars, question marks, cash cows, and dogs1. It looks at market share and growth to guide businesses. This framework helps companies make smart choices for profit and success.

Key Takeaways:

- The BCG Matrix is a strategic planning tool that categorizes products based on market share and growth.

- Stars are high-growth, high-market share products that need investment to stay strong.

- Question marks have low market share but high growth, needing careful thought and investment.

- Cash cows have high market share but low growth, making steady cash that funds other projects.

- Dogs have low market share and growth, often needing to be sold or restructured.

Understanding the BCG Matrix helps businesses improve their product portfolios and use resources wisely1. In the next parts, we’ll explore the BCG Matrix’s basics, key principles, and how to use it. This will help you grow and make more profit.

Understanding the BCG Matrix Fundamentals

The Boston Consulting Group (BCG) growth-share matrix is a key tool for strategic planning. It helps businesses analyze their product portfolio and decide where to put resources2. Introduced in 1970, it sorts products or services by market growth and share3.

Origins and Development of the Matrix

The BCG matrix was created by the Boston Consulting Group in 1970. It helps organizations evaluate their products and make strategic choices2. Today, it’s a common tool in portfolio management, helping analyze different products or business units3.

Core Components and Structure

The BCG matrix has four quadrants: Stars, Cash Cows, Question Marks, and Dogs3. A product’s position in the matrix depends on its market growth and share4.

Key Principles of Portfolio Analysis

The BCG matrix focuses on market share and growth as key success factors3. It suggests that high-growth, high-share products can lead the market, while low-growth, low-share ones need strategy3.

Yet, the BCG matrix has its limits. It might overlook customer preferences, innovation, and product life cycles3. Businesses should update their analysis regularly and use other tools for a full view of their products3.

| Quadrant | Characteristics | Example |

|---|---|---|

| Stars | High market growth, high market share | iPhone2 |

| Cash Cows | Low market growth, high market share | Macbook2 |

| Question Marks | High market growth, low market share | Apple TV2 |

| Dogs | Low market growth, low market share | iPad2 |

The Four Quadrants Explained

The BCG Matrix was created by the Boston Consulting Group in the 1970s5. It’s a tool for managing a company’s products. It sorts products into four areas based on market growth and share56.

The four quadrants of the BCG Matrix are:

- Stars: These products grow fast and have a big share of the market56. They need a lot of money to stay on top and grow more.

- Cash Cows: These products grow slowly but have a big share56. They make money easily and help fund other products.

- Question Marks: These products grow fast but have a small share56. They need careful thought to see if they can become Stars or if they should be sold.

- Dogs: These products grow slowly and have a small share56. They often need to be sold because they don’t make much money.

Knowing about these quadrants helps companies manage their products better56. Finance experts use the BCG Matrix to decide where to invest and grow5.

| Quadrant | Market Growth Rate | Relative Market Share | Strategic Implications |

|---|---|---|---|

| Stars | High | High | Require substantial investment to maintain dominance and capitalize on growth |

| Cash Cows | Low | High | Generate steady cash flow with minimal investment, providing resources for other products and investments |

| Question Marks | High | Low | Require careful analysis and investment decisions to determine if they have the |

| Dogs | Low | Low | Typically candidates for divestment or elimination, as they generate low returns and consume resources that could be better utilized elsewhere |

The BCG Matrix is useful but has its limits56. It only looks at market growth and share. Sometimes, other tools are needed to understand the market fully56.

“The BCG Matrix is a powerful tool for aligning product strategy with business goals, but it should be used in conjunction with other analytical frameworks for a complete understanding of the market landscape.”

Market Growth and Market Share Analysis

The BCG Matrix was created by Bruce Henderson in the 1970s7. It sorts products into four areas based on market share and growth89. This tool helps businesses understand their place in the market and decide where to put their resources for growth.

Calculating Market Growth Rate

The market growth rate is key in the BCG Matrix. It’s found by seeing how much a product’s sales change from one year to the next7. This formula shows which markets are growing fast and where to invest for more money.

Determining Relative Market Share

Relative market share is another important part of the BCG Matrix. It’s found by comparing a product’s sales to the top competitor’s in the same year89. This helps businesses see how they stack up against others and make smart choices about their products.

Understanding Market Position

Knowing the right market is key for using the BCG Matrix7. By looking at growth rates and market shares, companies can see where they stand and where to grow or cut back89.

| Quadrant | Market Growth Rate | Relative Market Share | Strategic Implications |

|---|---|---|---|

| Stars | High | High | Invest for growth |

| Cash Cows | Low | High | Milk for cash |

| Question Marks | High | Low | Selectively invest |

| Dogs | Low | Low | Divest or reposition |

By using the BCG Matrix, businesses can make smart choices to grow their product lines789.

“The BCG Matrix is a powerful tool that helps businesses analyze their product portfolio and make strategic decisions about resource allocation and investment. By understanding market growth and competitive positioning, organizations can develop targeted strategies to maximize their impact and drive long-term success.”

The BCG Matrix has been a key tool for businesses for decades789. It helps companies understand their market and make smart choices for growth. By focusing on market growth and share, businesses can reach their full growth and stay strong in the long run.

How to Use the BCG Matrix to Optimize Your Portfolio

The Boston Consulting Group (BCG) Matrix is a key tool for managing your portfolio10. It sorts your offerings into four groups: Stars, Cash Cows, Question Marks, and Dogs. These are based on market growth and your share of that market10. By understanding each group, you can make smart choices to boost profits and grow your business.

To use the BCG Matrix, first identify your key products or business units11. Then, figure out the market growth rate and your share of that market for each11. Plot these on the matrix to see where they fit in the four quadrants.

- Stars are leading products in fast-growing markets that need a lot of investment10.

- Cash Cows are top in slow markets, making steady money with little effort10.

- Question Marks are in growing markets but have a small share and an unsure future10.

- Dogs are in slow markets with a small share, costing more than they make10.

By looking at where each product stands, you can plan how to improve your portfolio10. You might invest in Stars to grow, keep Cash Cows for steady income, decide on Question Marks, or cut back on Dogs10. Using the BCG Matrix for careful planning can lead to a balanced and profitable mix of products.

| Quadrant | Characteristics | Strategies |

|---|---|---|

| Stars | High market growth, high market share | Invest heavily to maintain or grow market share |

| Cash Cows | Low market growth, high market share | Milk for cash, minimize investment |

| Question Marks | High market growth, low market share | Selectively invest or divest, evaluate possible |

| Dogs | Low market growth, low market share | Divest or minimize investment |

By matching your portfolio with the BCG Matrix, you can better manage your portfolio analysis, strategic planning, and resource allocation for growth and profit11. This framework helps businesses deal with market challenges and make smart choices for success.

“The BCG Matrix is a powerful tool, but it should be used alongside other methods to gain a complete view of portfolio performance, specially in service industries where trends and client relationships matter a lot.”

Strategic Implementation of Stars and Question Marks

In the fast-paced world of business, investing in products is key to staying ahead. The BCG Matrix is a tool that sorts products into four groups: stars, question marks, cash cows, and dogs12. Knowing how these groups work is vital for using resources well and aiming for lasting success.

Managing High-Growth Products

Stars are products with lots of market share and growth. They need a lot of investment to keep their spot and grab new chances12. As the market grows, stars can turn into cash cows, bringing in steady money for new plans13.

To keep stars strong, companies must fight off rivals, find new chances, and keep innovating. This keeps them leading the market.

Investment Strategies for Question Marks

Question marks are a special case. They grow fast but have little market share. They need careful thought and looking for ways to work with other products12. The aim is to turn question marks into stars by investing to grow their share and use their growth chance13.

Companies must think hard about question marks’ future, balance risks and rewards, and decide to invest big or let go. This choice depends on the product’s promise.

By getting the hang of stars and question marks, companies can craft smart product investment plans. This boosts their market leadership and growth strategies, pushing them forward.

“The BCG Matrix is a powerful tool that helps businesses navigate the complex landscape of product portfolios, enabling them to make informed decisions and maximize their competitive edge.” – John Doe, Marketing Strategist

Maximizing Cash Cows and Managing Dogs

In the BCG Matrix, Cash Cows are products that make a lot of money with little effort14. They have a loyal customer base, making them stable and profitable14. In tech, these are often older software that keeps bringing in big bucks14. The trick is to spend less while keeping the money flowing, keeping quality high, and making customers happy.

Dogs, on the other hand, are products with low market share in slow-growing markets15. They don’t make much money and need careful handling15. By focusing on Cash Cows, companies can free up resources to invest in new Stars or Question Marks. This helps in making more money and using resources wisely.

| Product Type | Market Share | Market Growth | Strategic Approach |

|---|---|---|---|

| Cash Cows | High | Low/Moderate | Harvest cash, maintain position |

| Dogs | Low | Low/Moderate | Divest, discontinue, or outsource |

By managing Cash Cows well and getting rid of Dogs, companies can have a balanced and profitable product mix14. This strategy, along with other models, helps in making better plans and decisions1415.

“Integrating multiple strategic models can lead to more robust evaluations of internal capabilities and external market conditions, improving overall strategic planning.”

Portfolio Balance and Resource Allocation

For organizations aiming for growth, a balanced portfolio is key. The BCG matrix helps categorize products by market share and growth rate16. It guides in making smart decisions about where to invest and prioritize.

Optimal Resource Distribution

The BCG matrix shows how to best use resources16. Stars need a lot of investment to grow and stay ahead17. Cash Cows, with steady cash flow, require little investment to keep their spot17.

Question Marks need careful investment for growth17. Dogs, with low market share, should get little support or be sold off.

Investment Priority Framework

The BCG matrix guides in setting investment priorities16. Invest in Stars for growth, keep Cash Cows running smoothly, and support Question Marks carefully. Dogs should get minimal support or be sold.

This strategy helps balance growth and risk. It focuses on promising products while managing risks of underperformers.

Risk Management Strategies

Managing risks is vital with the BCG matrix18. Regularly check your portfolio against market changes16. Use digital KPIs with traditional metrics for a full view of product performance16.

By using the BCG matrix, businesses can improve their strategy, invest wisely, and manage risks16. This approach helps navigate today’s business world and ensures long-term success.

“A well-balanced business portfolio will have a mix of Stars, Cash Cows, Question Marks, and few, if any, Dogs.”17

Common Challenges and Limitations

The BCG Matrix is a key tool in strategic planning, but it has its own set of challenges and limitations. It’s used for portfolio management and making strategic decisions19. The matrix helps categorize products or business units based on market share and growth rate. Yet, it simplifies the complex nature of market dynamics19.

One major issue is that the matrix relies too much on market share and growth rate to measure success19. Real-world business environments are shaped by many factors, like customer preferences and competition. These factors can greatly affect product performance19. The matrix’s fixed grid might not capture the changing nature of markets and products, leading to oversimplified decisions19.

Also, the BCG Matrix’s use of relative measures can lead to different categorizations based on the market scope19. It gives a snapshot of the market but doesn’t account for future changes. This is important for long-term planning and making strategic decisions19.

| Limitation | Description |

|---|---|

| Reliance on Market Share and Growth | The matrix uses only two factors, relative market share and market growth rate, to categorize products, overlooking other important considerations19. |

| Oversimplification of Market Complexities | The fixed grid approach may fail to capture the dynamic and evolving nature of markets and products19. |

| Potential for Inaccurate Categorization | The use of relative measures can lead to different categorizations depending on the scope and comparisons made19. |

| Lack of Future Outlook | The matrix provides a static snapshot and does not account for future changes in the market or portfolio evolution19. |

To address these issues, it’s essential to use the BCG Matrix with other tools like PESTEL analysis and Porter’s Five Forces. Also, consider the interdependencies among business units for a more complete view20. Using multiple criteria, combining absolute and relative measures, and regularly updating the matrix can improve its effectiveness. Scenario analysis and forecasting can also help overcome its limitations in portfolio management and strategic decision-making19.

“The BCG Matrix is a useful tool, but it should be complemented with other strategic frameworks to capture the full complexity of the market and drive informed, strategic decision-making.”

BCG Matrix in Modern Business Context

In today’s digital world, the BCG Matrix is as useful as ever for analyzing business strategies21. It sorts businesses by market share and growth rate. But now, it’s used in new ways to fit the tech-driven world21.

Digital Age Applications

Nowadays, companies use the BCG Matrix to check their digital products and online presence21. It helps them see which digital markets are growing fast21. The matrix’s four parts – Stars, Cash Cows, Question Marks, and Dogs – apply to digital products like apps and cloud software22.

Big tech names like Apple use the BCG Matrix to pick the best products and use resources wisely21. For Apple, the iPhone is a Star, leading in the smartphone market. MacBooks and iMacs are Cash Cows, making steady money22.

Contemporary Case Studies

Recent examples show the BCG Matrix is as useful today as ever21. Philips, for example, sold its TV business, seen as a “Dog,” to focus on better opportunities21.

Using the BCG Matrix with digital plans helps companies stay ahead23. It helps them choose where to put resources, spot chances for growth, and make smart choices22.

“The BCG Matrix is a powerful framework that helps companies navigate the complexities of modern business, empowering them to make strategic decisions that unlock new growth opportunities and maximize their competitive advantage.”

Integration with Other Strategic Tools

The BCG Matrix is a strong tool for planning, but it works best with other methods24. Using it with SWOT analysis, Porter’s Five Forces, or the Ansoff Matrix gives a full view of a company’s strategy24. This helps in making a detailed plan for growth24.

SWOT analysis shows a company’s strengths, weaknesses, opportunities, and threats. These can be used with the BCG Matrix to find key strategies24. Porter’s Five Forces helps understand the competition, guiding where to place products in the BCG Matrix24. The Ansoff Matrix adds by showing ways to grow, like entering new markets or developing new products24.

Using these tools together makes decision-making stronger. It leads to better use of resources, managing risks, and a stronger market position24. This approach helps companies deal with fast-changing markets and make smart choices about their products24.

| Strategic Tool | How it Complements the BCG Matrix |

|---|---|

| SWOT Analysis | Provides insights into internal strengths and weaknesses, as well as external opportunities and threats, to inform product positioning within the BCG Matrix. |

| Porter’s Five Forces | Sheds light on the competitive landscape, helping identify the appropriate quadrants for products based on market dynamics. |

| Ansoff Matrix | Outlines possible growth strategies, such as market penetration, product development, market development, or diversification, to complement the BCG Matrix’s insights. |

By using strategic planning tools, companies can create a complete strategy. This strategy optimizes their product portfolio and supports long-term growth24. Combining these complementary analysis methods leads to smarter decisions, better resource use, and a stronger market position24.

“The BCG Matrix alone may not provide a complete picture, but when combined with other strategic frameworks, it becomes a powerful tool for portfolio optimization and long-term success.”

Conclusion

The BCG Matrix is a key tool for managing a business’s portfolio and analyzing growth. It was created in the 1970s by the Boston Consulting Group25. This tool sorts products by market growth and share, giving insights for better portfolio management. The BCG Matrix has become a standard for businesses to handle strategic management.

Even though it has its downsides, like being too simple and missing out on competitors25, it’s very useful. It helps companies decide where to put their resources and plan for the future. By knowing the four types in the matrix – stars, cash cows, question marks, and dogs25 – businesses can make smart choices.

To get the most out of the BCG Matrix, businesses should use it with other tools like SWOT and PESTEL analyses26. This way, they get a full picture of the market and their own strengths and weaknesses. Using the BCG Matrix with these tools helps companies create a strong plan for the digital age.

FAQ

What is the BCG Matrix?

What are the four quadrants of the BCG Matrix?

How do you calculate market growth rate and relative market share?

What strategies are recommended for each quadrant of the BCG Matrix?

How can the BCG Matrix be used to optimize a company’s product portfolio?

What are the limitations of the BCG Matrix?

How can the BCG Matrix be adapted for the digital age?

How can the BCG Matrix be integrated with other strategic tools?

Source Links

- How can you use the BCG Matrix to optimize your organization’s product portfolio? – https://www.linkedin.com/advice/3/how-can-you-use-bcg-matrix-optimize-your-organizations

- Understanding the BCG Growth Share Matrix and How to Use It – https://www.investopedia.com/terms/b/bcg.asp

- How to Use a BCG Matrix – https://www.businessnewsdaily.com/5693-bcg-matrix.html

- BCG Matrix in Strategic Management: A Guide to Portfolio Analysis and Decision-Making | Creately – https://creately.com/guides/bcg-matrix-in-strategic-management/

- What is the BCG Matrix? Explaining its Components and Quadrants – https://www.peakframeworks.com/post/bcg-matrix

- How can you use the Boston Consulting Group matrix to analyze your product portfolio? – https://www.linkedin.com/advice/0/how-can-you-use-boston-consulting-group-matrix-8r85e

- BCG Matrix: Definition, 5 Steps, Uses, & Examples – https://quantive.com/resources/articles/bcg-matrix

- Introduction to the BCG matrix – https://lucidspark.com/blog/bcg-matrix

- BCG Matrix: What to Know and How to Use It | Leland – https://www.joinleland.com/library/a/bcg-matrix-what-to-know-and-how-to-use-it

- Using the BCG Matrix to Optimize Your Portfolio of Products and Services – https://falia.co/en/ressources/using-the-bcg-matrix-to-optimize-your-portfolio-of-products-and-services/

- How to Use the BCG Growth Share Matrix | ClickUp – https://clickup.com/blog/bcg-growth-share-matrix/

- Boston Consulting Group (BCG) Matrix – https://corporatefinanceinstitute.com/resources/management/boston-consulting-group-bcg-matrix/

- BCG Matrix: Evaluating Your Business Portfolio | startuptools.ai – https://www.startuptools.ai/resources/post/bcg-matrix-evaluating-your-business-portfolio

- Understanding the Cash Cow Matrix: Maximizing Business Potential | Creately – https://creately.com/guides/cash-cow-matrix/

- BCG Matrix for Maximizing Your Digital Product Success | Aguayo’s Blog – https://aguayo.co/en/blog-aguayo-user-experience/bcg-matrix-digital-product-success/

- How do you use the BCG matrix to allocate resources? – https://www.linkedin.com/advice/3/how-do-you-use-bcg-matrix-allocate-resources

- Balancing Your Business Portfolio – https://www.thinkers360.com/tl/blog/members/balancing-your-business-portfolio

- How can you use BCG matrix for better resource allocation? – https://www.linkedin.com/advice/1/how-can-you-use-bcg-matrix-better-resource-allocation

- What are the limitations or challenges of using BCG matrix in a dynamic and competitive environment? – https://www.linkedin.com/advice/0/what-limitations-challenges-using-bcg-matrix

- What are the benefits and drawbacks of using the BCG matrix for portfolio prioritization? – https://www.linkedin.com/advice/3/what-benefits-drawbacks-using-bcg-matrix-portfolio

- What is a BCG Matrix and how to use one I MiroBlog – https://miro.com/blog/what-is-a-bcg-matrix/

- BCG Matrix for Maximizing Your Digital Product Success | Aguayo’s Blog – https://aguayo.co/en/blog-aguayp-user-experience/bcg-matrix-digital-product-success/

- BCG Matrix – https://www.webfx.com/digital-marketing/learn/bcg-matrix/

- Leveraging the BCG Matrix and Beyond in Portfolio Product Management – https://medium.com/@arisatpathy/leveraging-the-bcg-matrix-and-beyond-in-portfolio-product-management-626dca65b9d4

- BCG Matrix: Definition + 5 Examples of use in 2024! – https://blog.waalaxy.com/en/bcg-matrix-definition-examples/

- BCG matrix: definition, analysis and use to set your priorities – https://www.proinfluent.com/en/matrix-bcg/